Investing in the Stock Market: A Scientist's View

My understanding of how investing in stocks work.

Introduction

Growing up in an Indian family, I had very little exposure to discussion and information about the stock market. People in India are generally less likely to invest in the stock market. Many view investments with suspicion. Indeed, most estimates put the percentage of the population that invest in stocks at 2-5% of the country’s total population [5, 6]. Unsurprisingly, investments were never really a topic of conversation in my home or in school growing up. The only remark I remember from my parents about it dismissed it as little more than gambling. School education in India is also lacking in this regard. Economics was either not taught or lumped in with other subjects such as history. I remember very little of economic theory actually being taught in school, especially for those who were aiming for engineering schools.

I was introduced to the idea of investing during my PhD through some of the friends I made here in Singapore. Investing is relatively common here. It was interesting to see articles like this highlighting that around 33% of Singaporeans do not invest. Culturally, investing enjoys relative popularity here as a way to keep ahead of inflation and to grow savings. Always the scientist, I set out to understand the underlying principles behind investing in the stock market before I started. There is no dearth of articles on the internet with advice on getting started with investing in the stock market. However, a lot of the articles that I read left me unsatisfied as a scientist. Observations - like the fact that money loses value over time - were often presented as assumptions and discussions about the benefits of investing tended to be biased towards the investor; with the central point of most articles being that investing can grow your money. While I learnt quite a bit about investing, I was left with many unanswered questions. For instance, why does the assumption that money loses value over time hold? Who benefits from a healthy stock market apart from the investors?

These questions led me down a rabbit hole of academic articles about economic theory and monetary planning. I wrote this article for people who, like me, did not grow up in a culture of investing and would like to know of the raison d’être of stock markets. The article contains some of the information that helped me make an informed decision about whether I should invest in the stock market.

Inflation and Economic Growth

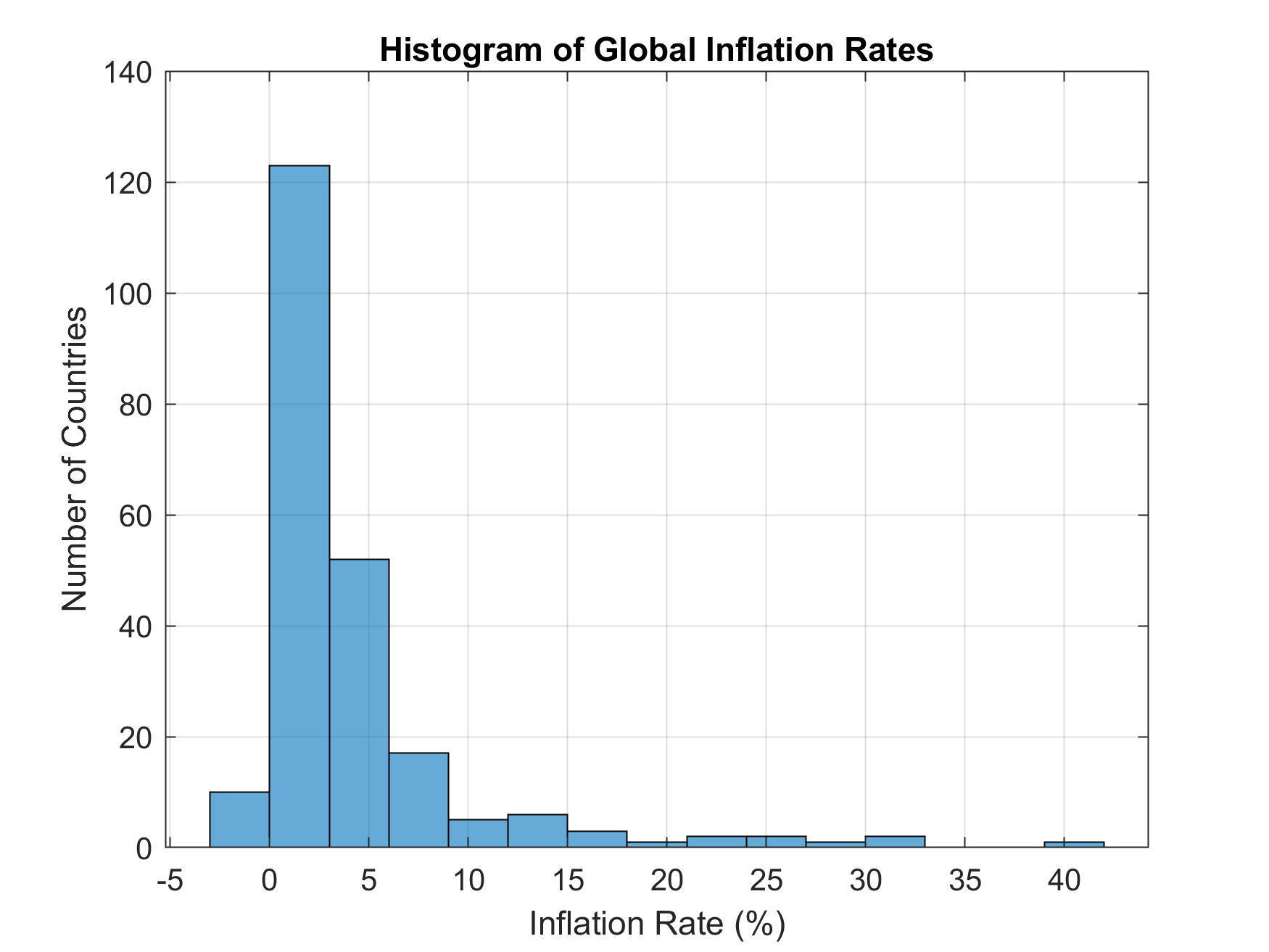

The story starts with the assumption that money will lose value over time. Economists use the term inflation to refer to this phenomenon. When an economy experiences inflation, the prices of things increase over time. So, the same amount of money buys less things in the future than it buys today. Most countries experience a positive rate of inflation [4].

Countries consider this a good thing. In fact, some countries even engage in something called “Inflation Targeting” to make sure that the rate of inflation remains at a low but stable and positive level. But if countries are willing and able to influence the rate of inflation, why do they target a positive inflation rate? Why not target zero? Or better yet, why not target a negative inflation rate and let money increase in value over time, and reward people who save their money?

Deflation is when the prices of things decrease over time. That means money becomes more valuable as time goes on. The average person might consider this a good thing. If I save up money right now and just hold on to it long enough, I’ll be able to afford that expensive home or car eventually. But this effect of delaying purchases for the future appears to have a negative effect on the overall economy. Growth slows, unemployment rises, and businesses start to shut down as demand for the things that they make decreases. Deflation also increases the risk of a deflationary spiral - in which falling demand and prices and rising unemployment becomes a runaway positive feedback loop. Many economists think that such a spiral was responsible for the Great Depression of the 1930s.

Is inflation better? A high rate of inflation is also considered a bad thing. If inflation is too high, the value of people’s savings decreases too fast and wages do not increase fast enough. This results in people hoarding physical goods. Hyper-inflation can also lead to a runaway positive feedback loop in the opposite direction.

As a result, keeping the economy on track is a balancing act. Countries target an inflation rate that is in the low single digits so that there is enough of a buffer zone between the current state of the economy and deflation and use regular updates to monetary policy to prevent runaway inflation. The United States for example targets a yearly inflation rate of 2%.

In other words, governments give more importance to price stability than anything else. Both deflation and high rates of inflation slow down economic growth and have negative effects while low rates of inflation offer price stability and controllability.

Given that modern economies tend to prefer inflation and actively try to maintain it, holding on to money means that the value of your money will decrease (albeit slowly) over time in most countries in the world. So, if people want to keep their savings from losing value, they need to do something with their savings other than hiding it under their pillow.

Bank Savings Accounts

One way for people to save in an inflationary economy is to use a savings account in a bank that offers to periodically pay you a certain percentage of the money as interest. This is the form of savings that most people are familiar with. Some banks offer special “fixed deposit” accounts that you can put money into and take out only after a certain amount of time. If the savings account offered by the bank has a rate of interest that exceeds or is very close to the rate of inflation then your savings will keep most of their value over time. For many people this form of saving is perfectly fine. If people choose banks that are large and reliable, the risk of losing money is very low. And as long as you live within your budget, you’ll be perfectly happy person. This style of investment is good for people who are very risk averse or for people who plan to retire soon.

The opportunity cost of saving money like this is of course the fact that money invested in the stock market could potentially increase in value much faster than a bank savings account will allow. For instance, the value of the stocks in Google has increased by 25% since November 2018. This beats interest rates by a large amount. But the keyword here is “potentially”. When you put money into the stock market, there is also the risk that the money can be lost - sometimes entirely. Where does this money come from and where does it go? And why do stocks offer such large potential returns? To answer these questions, I need to go into why the stock market exists in the first place.

Businesses Need Capital

Starting and running a business is no small task. Businesses typically need large amounts of money to get started. They may need office space, they may need to build factories and make expensive prototypes to perfect their technology. Sometimes businesses decide to expand by improving their products or making entirely new ones. One way to finance these costs is to use bank loans. This is in fact what a lot of companies do. However, the amount of money that banks can loan out is limited. Companies also need to pay an interest on the loans. So, if the company is working on something that will not produce a profit for some time, the interest on their loans can accumulate quite fast.

Somewhere along the way people had the idea to raise money from regular people instead. However, rather than having people loan the business the money, the business would offer a small chunk or a share of itself in exchange for money. Once the business becomes profitable, the person with the share would be entitled to a portion of the profits. Partial ownership also granted other benefits. The shareholder could have a say in how the company was run and help choose managers. The stock market is a place that facilitates the buying and selling of these chunks of companies (for a fee of course). The Amsterdam Stock Exchange, established in 1602 is considered the oldest such place. The price of the share of a company is determined by the forces of supply and demand. Simply put, the value of stock is what people are willing to pay for it. If people think that a stock is valuable because the the company has the potential to grow, the stock gets more expensive because the demand for the stock is higher than the supply. If people think the company has no future, the stock’s value falls as more people are trying to sell the stock, increasing its supply.

Businesses benefit from this because they can quickly raise money at 0% interest. As long as they don’t part with more than 50% of the company ownership, they can even retain full control over what happens in the company. Many economists think that by letting more people participate in the economy, there is more money available for people to start businesses and make things. This leads to more growth as it encourages people make more new things and the overall ‘value’ of the economy increases (because now there are more things (knowledge, services, technology) in the economy.

Most articles I’ve read talk about how investing is important because it lets you make money compared to just holding cash. But I feel that these articles are missing the more important point that having a stock market setup as a cornerstone of the world’s economic system could be the principal reason that human civilization has seen such amazing growth in knowledge and technology. This, in my view is a far more important reason to invest and to participate in the economy than the personal goal of getting more money. The stock market appears to be set up so that participating in it offers benefits to both businesses and the investors even if they do not know and care about the meta-goal of sustained growth of human civilization.

The Stock Market Gains Value in the Long Run

While the sustained growth of human civilization is a fine goal, the most pertinent question for the individual investor is the risk of losing their money. If I buy stocks in a certain company and it folds, I do not get most of the money back. So what’s in it for the individual investor?

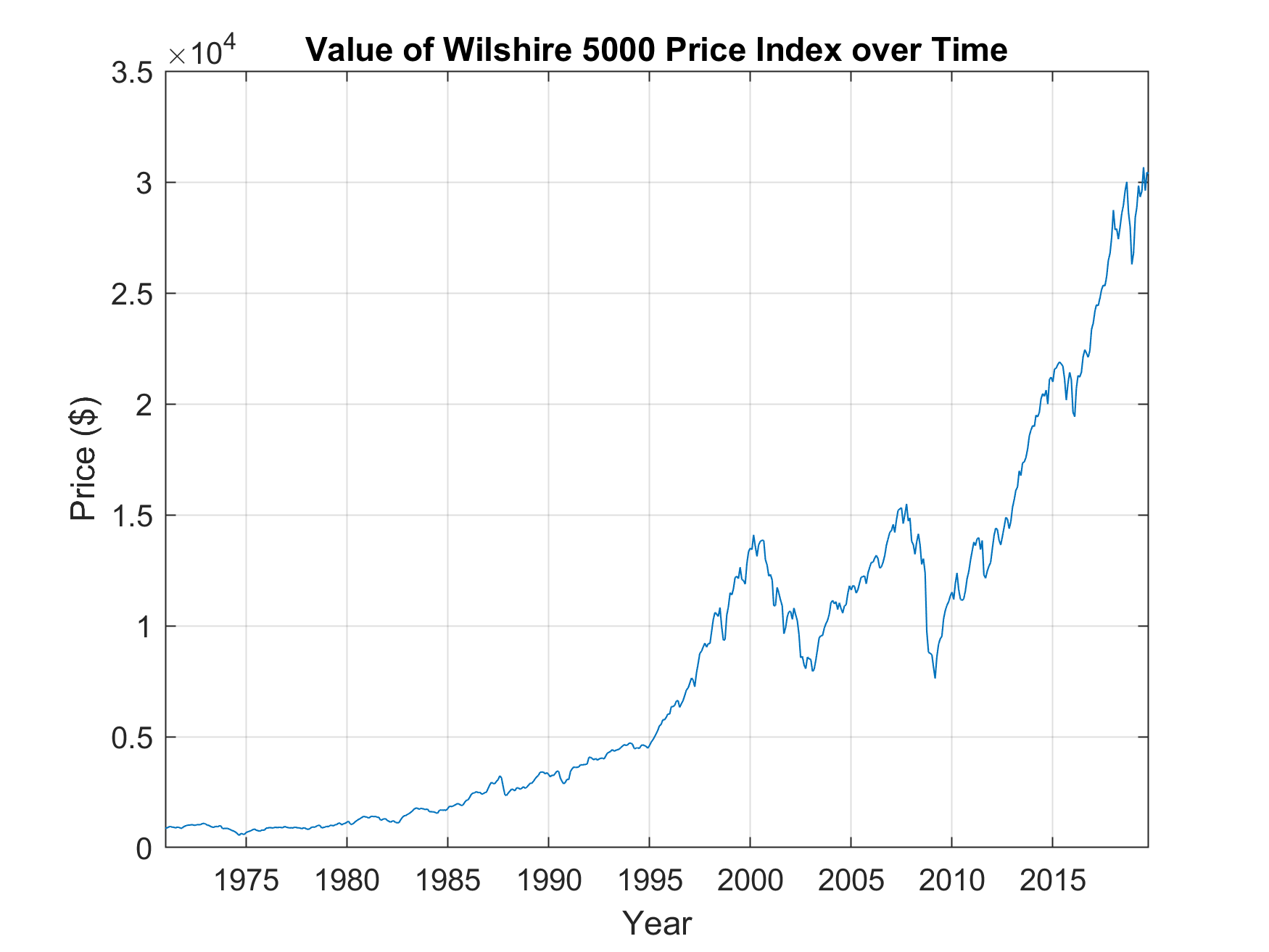

While single stocks can lose value over time and even drop to zero, the stock market as a whole tends to rise in value over time. Stock markets have indices that track the value of a set of stocks over time. In a pattern that has remained consistent for decades, the market as a whole tends to gain value in the long run. While economic recessions like the one that happened in 2008 can reduce the value of stocks in the short term, in the long run (over the course of tens of years), they gain in value. The graph below shows the value of the total US stock market as represented by the Wilshire 5000 Price Index over time [8].

Many such indices in other countries show a similar trend. For individuals then, the incentive is that even by “passively” investing in the entire stock market (a facility available through something called index funds) their savings grow over time with a high probability. For companies that are listed on the stock market, the incentive is that they have access to large amounts of capital to fund their growth. Individual companies can fail and try again. While individual investors can never reduce the probability of losing all their money to 0, they can reduce it significantly by buying and holding a diverse set of stocks.

The Other Side of the Coin

This is of course not the complete story. I’ve only mentioned the bare essentials of the system. There are other ingredients needed to ensure that the growth generated by this economic system is sustainable. One of the most obvious problems is that the shareholders of a company may only care about making money. This means that the company would try to maximise profit above all else in a way that can be harmful for humanity as a whole. Part of the reason is that economic activity generates costs apart from that of labor and raw materials. These external costs - such as the generation of planet warming greenhouse gases - means that there is a need for well desiged regulations that ‘bake in’ these external costs into the cost of running businesses. Implementing things like a carbon tax or a pollution cleanup tax will probably be necessary in the coming years to make sure that our economic activity does not mess up the planet that we live in.

So, with some well-planned regulations, carefully controlled inflation and thriving stock market humanity should be set for growth - at least until the next disruptor comes along. An AI singularity perhaps?

References

- Wikipedia Article on Deflation

- Friedman, Benjamin M. Monetary policy. No. w8057. National Bureau of Economic Research, 2000.

- Remarks by Governor Ben S. Bernanke

- Inflation Rates by Country, CIA World Factbook

- Indians have a love-hate relationship with stock markets, says CEO of Asia’s first stock exchange

- Majority of states have very few stock market investors

- 1 in 3 Singaporeans does not invest, most financially unprepared for retirement: OCBC survey

- Wilshire 5000 Price Index Historic Data